Circles: Save Together Secure Savings On-Chain!

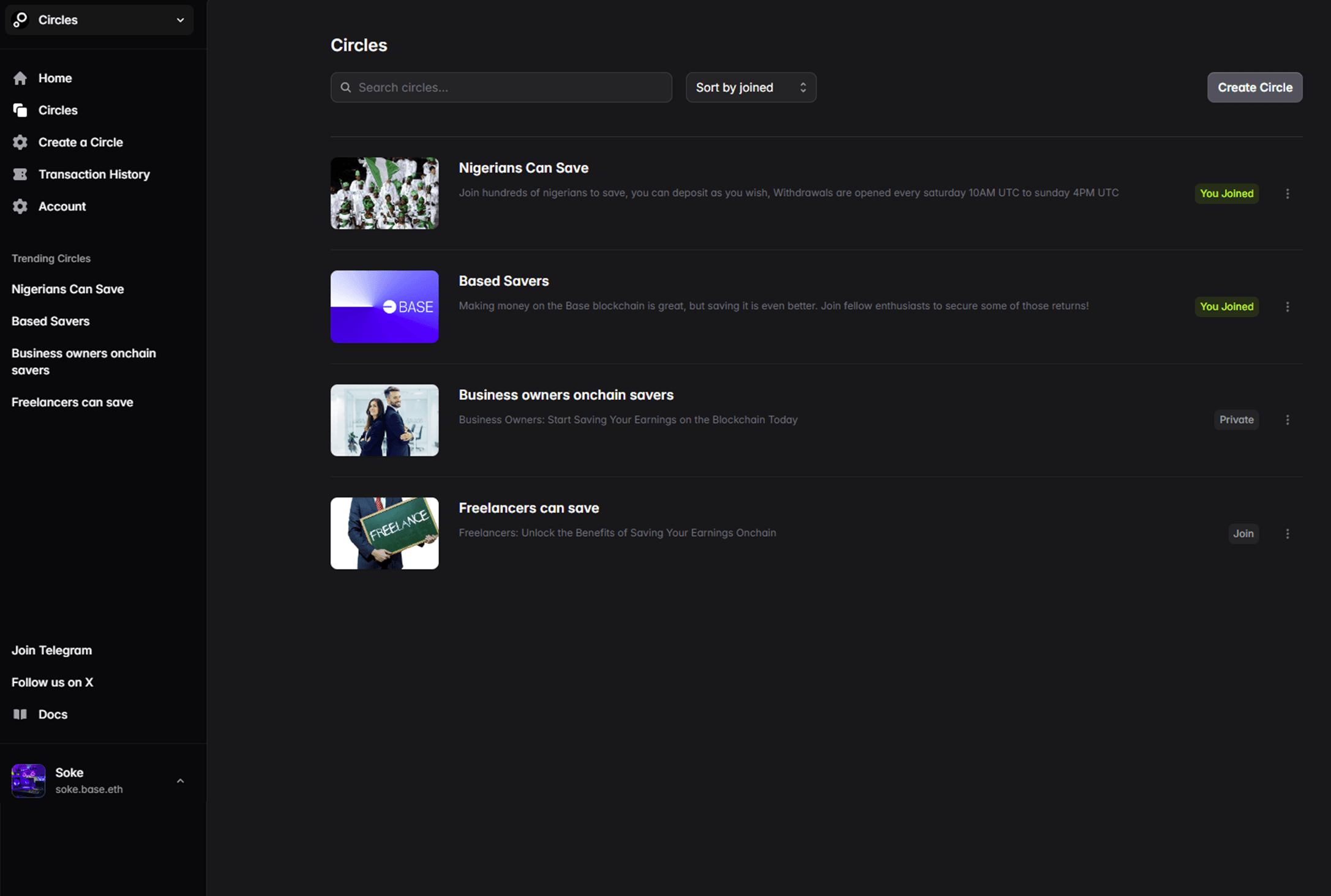

Circles is a decentralized savings platform where users save together and enjoy friendly competition. With funds securely stored on the blockchain, saving is both fun and safe ⚆ grow your wealth together!

Powered by

Features

With Circles, saving together is more secure, social, and engaging than ever before!

Join groups of savers, pool resources, and boost your savings potential by collectively reaching financial goals.

Reasons Circles Outshines Traditional Savings

Circles transforms saving by combining group contributions, blockchain security, and fun rewards. It’s a safer, more engaging alternative to traditional savings methods.

Engagement & Rewards

Circles makes saving engaging through friendly competition and rewards for hitting group milestones, transforming saving from a static, individual process to an exciting, social experience. Web2 savings can’t match this level of fun and motivation!

Decentralized Security

Traditional banks rely on central authorities, but with Circles, your savings are stored in secure, transparent smart contracts on the blockchain. No one but you and your circle have access, eliminating third-party risk and bringing unmatched peace of mind.

Collaborative Power

Unlike traditional saving accounts, Circles lets you save with a group, friends, family, or co-workers, boosting your financial potential through collective contributions and shared goals, something Web2 platforms don’t offer.

Engagement & Rewards

Circles makes saving engaging through friendly competition and rewards for hitting group milestones, transforming saving from a static, individual process to an exciting, social experience. Web2 savings can’t match this level of fun and motivation!

Decentralized Security

Traditional banks rely on central authorities, but with Circles, your savings are stored in secure, transparent smart contracts on the blockchain. No one but you and your circle have access, eliminating third-party risk and bringing unmatched peace of mind.

Collaborative Power

Unlike traditional saving accounts, Circles lets you save with a group, friends, family, or co-workers, boosting your financial potential through collective contributions and shared goals, something Web2 platforms don’t offer.

What Our Users Are Saying?

Discover how Circles is changing saving! Read testimonials from users who have enjoyed collaborative saving, enhanced security, and a vibrant community while achieving their financial goals!

I’ve been looking for a blockchain-based saving platform, and Circles is exactly what I needed! The on-chain security is excellent, and saving collaboratively is a game-changer for financial empowerment in Africa!

BelialInvestor, Abuja

As a mother, I need secure ways to save for my children’s future. With Circles, I save confidently on-chain, knowing that my funds are protected and easily accessible

Celina AlfredoUnited Kingdom

Circles don change di way we dey save for Naija! E dey secure for blockchain, so I no get wahala with my money. Plus, I fit dey save with my guys! Na better vibe!

Whedo StanleyWarri, Nigeria

Frequently asked questions

Have questions about Circles? We’ve compiled a list of frequently asked questions to help you understand how our platform works, its benefits, and how you can get started.

What is Circles?

Circles is a decentralized savings platform that allows users to save collaboratively with friends, family, or co-workers while securely storing funds on the blockchain.

How does saving in Circles work?

Users can create or join saving circles, where they pool their resources and save together, enjoying friendly competition and rewards for reaching financial goals.

What are the benefits of using Circles over traditional savings methods?

Circles offers collaborative saving, blockchain security, and engaging competition, making saving more fun, secure, and motivating than traditional savings accounts.

Can I withdraw my savings at any time?

Yes, you can withdraw your savings from your circle at any time, as long as you follow the guidelines set by your circle.

How fast are transactions on Circles?

Transactions on Circles are fast and efficient, powered by Base, a quick and affordable blockchain. This means your transactions won’t get delayed or stuck, ensuring a smooth saving experience.

Is my money secure on Circles?

Yes! Your funds are stored on-chain in a secure smart contract, ensuring complete transparency and eliminating the risk of third-party access.